Lifestyle + Financial Articles

Essential + Current Mortgage Insights

Stay informed about the ever-changing mortgage landscape.

4 Ways to Protect Against Title Fraud in BC

When I was a kid, my dad would leave muddy work boots on the porch so it always looked like

Title Fraud in BC: 5 Risks Every Homeowner Should Know

Picture this: you’re sipping your morning coffee when you stumble across a shocking discovery—your home is listed for sale, and

Mortgage Without Recent Tax Returns? 5 Steps to Take

If you’re trying to get a mortgage but haven’t filed your taxes—don’t panic. This happens more often than you’d think.

Getting Mortgage-Ready: 4 Key Steps to Take Before You Apply

Getting mortgage-ready doesn’t have to be complicated. The earlier you prep your finances, the smoother the process. These four practical

2024 Tax Return Reminder for Mortgage Applications

As the tax filing deadline approaches, it’s important to remember that lenders will soon require 2024 tax returns when assessing

Discover Hidden Savings in Your Mortgage – Here’s How!

When most people think about mortgages, they focus on one thing: the interest rate. But what if your mortgage

How Removing a Co-Signer Could Lower Your Mortgage Costs

When you first bought your home, you might have needed a co-signer — someone who helped you qualify by strengthening

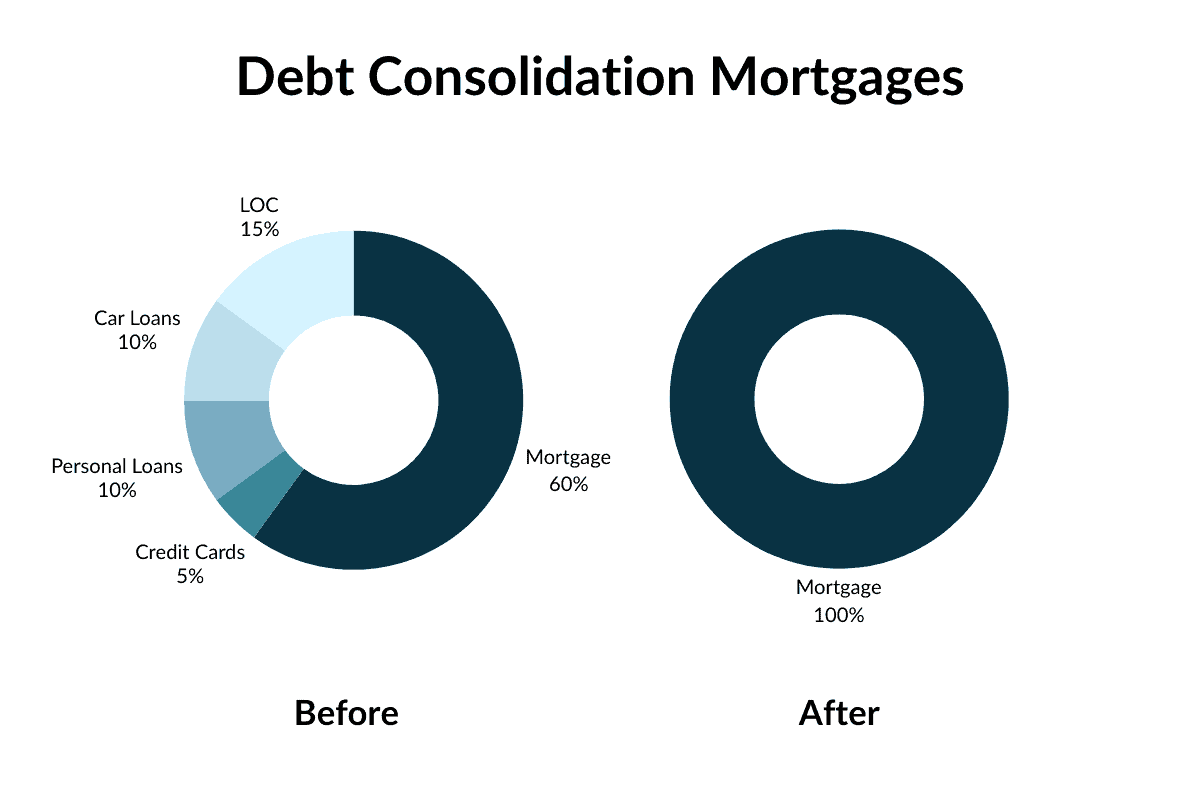

Simplify Debt & Save Thousands with a Consolidation Mortgage

If you’re juggling multiple debts and feeling the pressure of high-interest payments, you’re not alone. Many homeowners in BC are

Why I Sometimes Recommend My Clients Work with the Competition!

At Paul Hudson Mortgage Wealth, my priority is always doing what’s best for my clients—even if it means not completing a mortgage