Home Purchase Mortgages in Squamish

Maximum value for your biggest investment

A house is so much more than a place you call home. It’s your sanctuary, but it’s also your biggest financial investment, and it can play a significant role in building your wealth if you have the right pieces in place.

Maximum value for your biggest investment

A house is so much more than a place you call home. It’s your sanctuary, but it’s also your biggest financial investment, and it can play a significant role in building your wealth if you have the right pieces in place.

We work differently than other mortgage brokers. Our approach to setting you up with the right mortgage is holistic and strategic, because we believe that a mortgage is an opportunity to build wealth over the long term.

By working first to understand your goals and circumstances, we’re then able to leverage factors such as down payment size, term length and repayment options to strategically build your financial position. Every mortgage we secure is customized, so you get more than just a home. You get a solid financial plan for the future.

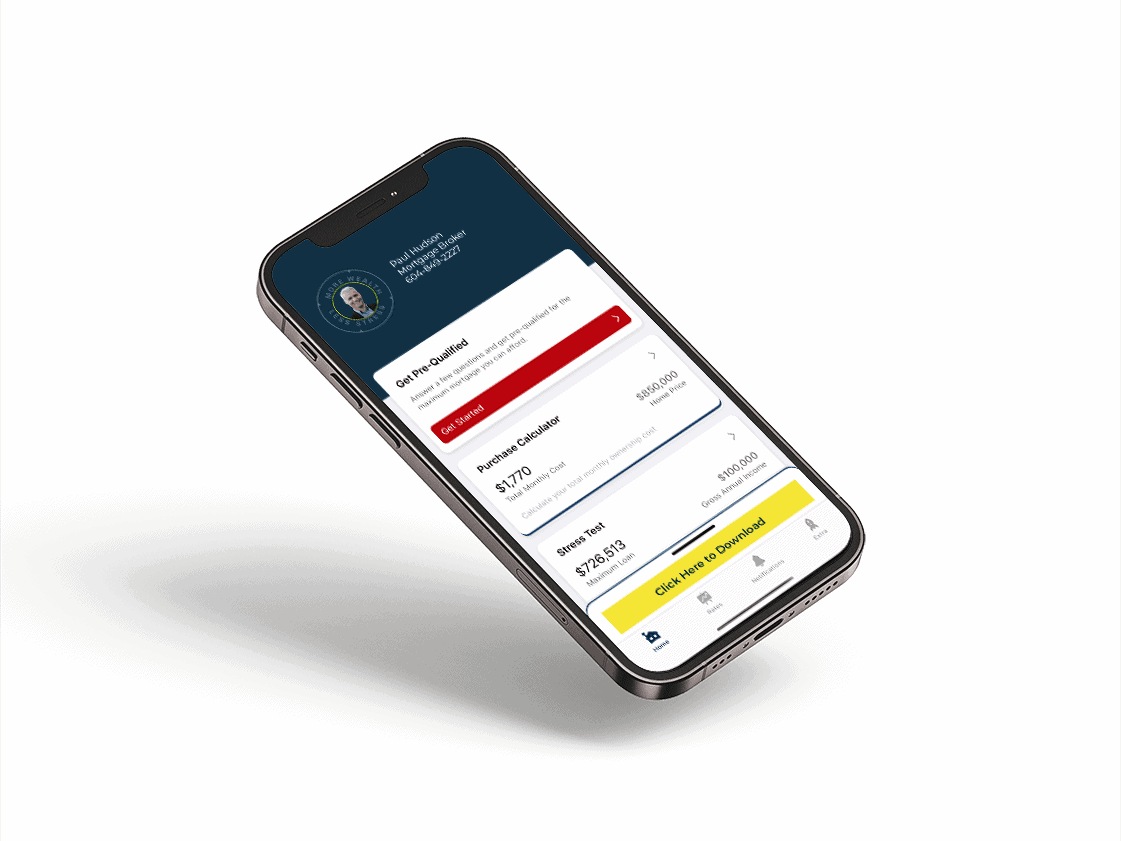

Your free and comprehensive mortgage calculator app is here!

This powerful tool will help you take control of your financial future with ease and confidence.

• Compare rates from hundreds of lenders

• Personalized and detailed reports

• Determine your maximum purchase price

• Breakdown of all your closing costs

• Simulate debt payoff and adjust payments

Personalized Home Purchase Mortgage Solutions

Unique mortgage solutions designed for your unique lifestyle

Shopping for a mortgage can feel confusing, intimidating, complicated and time-consuming. We simplify the mortgage process to save you money, time and frustration, and to ensure you get the right fit for your needs.

As independent VERICO advisors with access to over 50 mortgage lenders, we offer the best match for your lifestyle goals, financial situation and unique circumstances.

Award-winning Squamish Mortgage Broker

Meet Paul Hudson

Paul Hudson, principal of Paul Hudson Mortgage Wealth, is an award-winning Mortgage Broker with over 20 years of professional experience. Paul founded Paul Hudson Mortgage Wealth with the bold vision to inspire people to achieve their wealth potential through mortgage opportunities.

EXCELLENTTrustindex verifies that the original source of the review is Google. Paul was referred to us by friends who also just recently purchased their first home! We were more than happy we chose to go with him and his team. He was great at explaining things thoroughly to us as we were new to the whole process and answered our questions very promptly! Paul was very personable and you can certainly tell he cares about his clients and takes pride in his work. I would strongly recommend using Paul and his team for any mortgage needs! All the stress associated with buying your first home, was very minimal while having him in our corner!:)Posted onTrustindex verifies that the original source of the review is Google. Paul was referred to us by a good friend of ours and we are more than happy we chose to go with him and his team. Paul helped us purchase our first home with ease, he was absolutely excellent to work with. Paul was great at explaining things thoroughly to us as we were new to the game and was very reassuring throughout the process. Paul felt very personable and you can certainly tell he care about his clients. I strongly recommend using Paul and his teamPosted onTrustindex verifies that the original source of the review is Google. Paul and his team were amazing to work with! Seamless mortgage renewal! Thank you!Posted onTrustindex verifies that the original source of the review is Google. I had a great experience working with Paul on my home purchase. He made the mortgage process a lot easier than I expected and was always on top of things. He took the time to explain my options, answered all my questions, and made sure everything stayed on track for closing. I really appreciated how responsive and straightforward he was—no runaround, just solid advice and a smooth process. If you're looking for a mortgage broker who knows their stuff and actually cares, I'd definitely recommend Paul.Posted onTrustindex verifies that the original source of the review is Google. We were put in touch with Paul when a completely unexpected, once in a lifetime opportunity presented itself. We thought we had exhausted all our options but Paul was able to find not only one, but three different ways for us to secure our dream property with an expedited timeline. We were able to put in an offer within days and close on financing within 2 weeks. To say Paul is good at his job is a massive understatement, he’s professional, knowledgeable and damn efficient. People who are good at their craft don’t need to advertise as their work speaks for itself. I can’t recommend Paul highly enough.Posted onTrustindex verifies that the original source of the review is Google. Paul was very helpful to us as we explored financing options for our cross-border condo purchase. Highly recommended if you want to be able to compare offers and be sure you are getting the best deal.Posted onTrustindex verifies that the original source of the review is Google. Paul was awesome and super friendly. His team is also very professional and easy to work with. 100% would recommendPosted onTrustindex verifies that the original source of the review is Google. We used Paul and his team as we were finalizing our house purchase at distance, and needed someone whom we could trust. I highly recommend Paul’s services- they were very communicative, helped us push through a quick close by getting us through all the steps and paperwork quickly, and helped us secure a great interest rate with a great lender. I would highly recommend Paul and his team to anyone purchasing a home, especially first time homebuyers!

Your Local Mortgage Experts

Serving Towns & Cities Across the Province

We service across British Columbia including:

Frequently Asked Questions

What's Your Lowest Rate?

When purchasing a home, the lowest interest rates on the market can be sourced through the mortgage broker channel. More specifically, these low rates are offered when a buyer obtains high-ratio mortgage insurance, which applies when the down payment is less than 20% and the purchase price of a primary residence is under $1.5 million.

At Paul Hudson Mortgage Wealth, my team and I have access to over 50 lenders, allowing us to find the most competitive rate for your situation. More importantly, we focus on structuring your mortgage to align with your short- and long-term financial goals.

Many low-rate mortgage products come with restrictions—such as high penalties for breaking the mortgage early or limited prepayment options—that could cost you more over time. We’ll walk you through your options so you can make an informed decision that balances rate, flexibility, and overall savings.

What's The Most You Can Lend Me?

The maximum amount you can borrow depends on several factors, including your income, existing debts, credit score, and the type of property you’re purchasing. Lenders use specific guidelines—such as your debt service ratios—to determine how much you qualify for.

We take a personalized approach. Rather than just giving you a quick estimate, we’ll go through a pre-qualification or full pre-approval process to ensure we’re providing accurate numbers. This helps you understand what lenders will offer and how different mortgage structures could impact your borrowing power.

Do You Need to Check My Credit, and Why?

Yes, checking your credit is a key part of the pre-approval process—it’s one of the crucial first steps. Lenders use your credit score and history to determine how much they can lend you and at what interest rate. By reviewing your credit upfront, we ensure that your pre-approval is based on real numbers, not just estimates.

A credit check also helps us identify any potential issues early on, giving us time to address them before you make an offer on a home. The good news is that a single mortgage-related credit check has a minimal impact on your score, so there’s no need to worry about it hurting your ability to qualify.

Why Is So Much Documentation Required for My Mortgage Application?

Lenders require detailed documentation to verify your income, debts, and overall financial situation. This helps ensure that you qualify for the mortgage and that we’re securing the best possible terms for you. Since a mortgage is one of the largest loans you’ll take, lenders need to assess risk carefully—just like they would with any major financial decision.

We know the paperwork process can feel overwhelming. That’s why my team and I streamline everything for you. We’ll provide a clear checklist, explain why each document is needed, and work proactively to avoid last-minute lender requests.

Why Do You Need to Review My Bank Account History?

Lenders require a 90-day history of your bank account to confirm that your down payment is coming from legitimate sources, such as savings, investments, or a gift from an immediate family member. This is part of Canada’s anti-money laundering regulations, which all lenders must follow.

Lenders want to ensure the funds haven’t been borrowed or suddenly appeared in your account without a clear source. If there are large deposits, we may need to provide additional documentation to verify their origin.

We understand that gathering paperwork can be time-consuming, but my team and I are here to guide you through the process. We’ll make sure you have exactly what’s needed to keep things moving smoothly.